I am going to begin this with a repeat of a somewhat comprehensive post I made in April 2005. The first thing to do is to find the country, and for those who aren't sure where it is, it lies North of Iran on the Eastern side of the Caspian Sea.

It is ranked as having either the fourth or fifth largest reserves of natural gas, with reserves of 2 tcm (trillion cubic meters) (the CIA), 5.5 tcm the Jamestown Foundation, or 8.1 - 8.7 tcm Library of Congress. It exports around 38.6 bcm per year, and uses around 15.5 bcm itself (CIA), for a total production of around 55 bcm.

Historically the natural gas has been sold to Russia, and the Ukraine, but very much under the thumb of the Russian purchasers. As the EIA notes

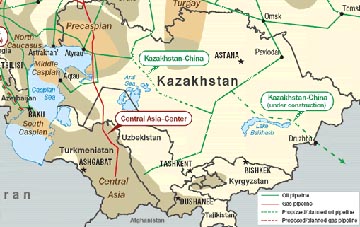

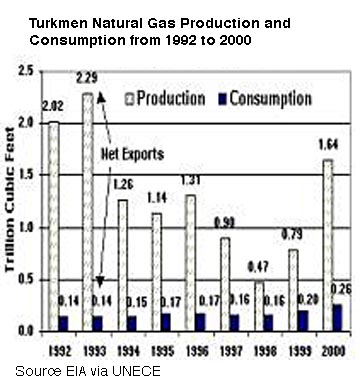

Prior to 1997, the only option for exporting Caspian region natural gas was via the Russian natural gas pipeline system. Although over 2 trillion cubic feet (Tcf) of Caspian Sea region natural gas was piped via the Central Asia Center gas pipeline in 1990, exports fell to 0.3 Tcf in 1997 when Russia's Gazprom, which is a competitor with Turkmen natural gas and owns the Russian pipelines through which Turkmenistan exports, denied Turkmenistan access to the system over a payment dispute.

(Source EAI)

(For those like me who have problems with conversions, 1 Tcf is roughly 30 bcm). The story from the Research Divn of the Library of Congress is slightly different.

In 1992 gas production accounted for about 60 percent of GDP. As a result of a dispute with Ukraine over payments for gas deliveries, in 1992 gas production fell by 20 billion cubic meters to around 60 billion cubic meters. In the first eight months of 1994, transportation restrictions forced Turkmenistan to cut gas production to 26.6 billion cubic meters, only 57 percent of the production for the same period in 1993. An additional factor in this reduction was the failure of CIS partners, to whom Russia distributes Turkmenistan's gas, to pay their bills.

With limited ways of selling its gas Turkmenistan was stuck with selling it through Russia, with 918 bcf staying in Russia while 117 bcf went on to Ukraine during 2000. Exports continued to rise by about 25% a year. The UNECE continues the story.

In a bid to secure a market for its natural gas, on May 14, 2001, Turkmenistan agreed with Ukraine on a major natural gas export deal. Under terms of the deal, Turkmenistan will provide Ukraine with 8.83 Tcf of natural gas between 2002 and 2006. Turkmenistan will sell Ukraine 1.41 Tcf of natural gas in 2002 and 1.77 Tcf in 2003, with remaining deliveries to be agreed later. Turkmen officials signed the deal on the condition that Ukraine makes timely payments for supplies. Ukrainian officials agreed to pay for the Turkmen natural gas 60% in cash, with the remainder paid for through participation in 20 construction and industrial projects in Turkmenistan worth a total of $412 million.

Unfortunately disagreements over payments have continued. First in the winter of 2004

In December 2004, Turkmenistan halted gas supplies to Russia and reportedly demanded $60 per 1,000 cubic meters (35,300 cubic feet). Turkmenistan presumably expected that the perceived inability of Gazprom to meet its export and domestic commitments without Turkmen gas volumes would force the Russian giant to offer better terms. However, Turkmenistan failed to force Russia to pay more for Turkmen gas, as Gazprom passed through the 2005 winter season of peak demand for natural gas without Turkmen supplies. Subsequently, in April 2005 Russia and Turkmenistan agreed that Gazprom would make all payments in cash instead of the earlier barter arrangements, yet the price remained the same: $44 per 1,000 cubic meters.

The situation deteriorated further with the clash between Ukraine and Russia gaining the attention, among others of The Energy Bulletin as the debate over price escalated. Unfortunately for Turkmenistan, the solution allowed Russia to sell at world price, while using the cheaper Turkmen gas to keep the average price at $95 per 1,000 cu.m.. That debate is not over. The price itself was not actually fixed

The next day, on Feb. 2, RosUkrEnergo agreed to stipulate in a contract that it will supply gas to Ukraine at $95 per 1,000 cubic meters during the next five years. However, RosUkrEnergo reserved the right to boost the prices if Turkmenistan, the main gas source for the company, moves to hike the prices.And so the debate continues. Novosti had two stories on this in the past two weeks.

The issue is sensitive for Ukraine, whose chemical and steel companies would become unprofitable if gas prices exceed $95, analysts said.

Under a bilateral treaty, Turkmenistan is to ship 40 billion cubic meters of gas at $50 per 1000 cu m in the first half of the year and at $60 per 1000 cu m in the second. Turkmenistan's foreign ministry earlier said that Ukraine was delaying payment for natural gas shipments and threatened to cut off supplies unless the Ukrainian side cleared the outstanding debt. If that were to happen, it would be the second time a supplier had turned off the taps to Ukraine, as Russian energy giant Gazprom cut supplies on January 1 amid a bitter dispute over prices for natural gas supplies. . . . . . According to Turkmenistan, Ukraine's debt stands at $158.9 million and the country's foreign ministry said a failure to settle the debt could place energy cooperation in doubt.

This was followed by

Ukraine's prime minister said Wednesday his country's debt to Turkmenistan for natural-gas supplies stood at $68 million, and that it would be paid off by supplies of industrial goods.

"As of this moment, Ukraine's debt to Turkmenistan stands at $68 million," Yuriy Yekhanurov told a Cabinet session, adding that Kiev had already ironed out all its problems concerning natural gas supply obligations with Ashgabat. Turkmenistan says Ukraine's debt currently stands at $158.9 million, and President Saparmurat Niyazov has urged Ukraine to pay up.

Unfortunately the attitude of the Ukrainians to such debt is not reassuring to Turkmen

(On) or the issue of 7,8 billions of cubic meters of Russian natural gas, that had allegedly disappeared while being transferred through the Ukrainian territory.It is no wonder that Turkmenistan is becoming frustrated with customers to the North and West, and so it is again trying a harder line. From Radio Free Europe

That of course is incorrect. However, the specifics of the gas transit system does not allow refuting this fact easily. Should Ukrainians have dealt with the issue in a more professional manner, the myth would be damaging to Gazprom itself. First of all, if the gas was stolen -- that should have happened before 2005, when other people were governing Ukraine. And let us remind the reader, that Gazprom was supporting these people..

Therefore, the question shall be posed to the great friends of Russia like Kuchma, Yanukhovich and Boiko (former chief of Naftohaz). And there are all reasons to suspect, that like any other transaction in the sphere of fuel and energy the `steeling' of the Russian gas resulted into the personal benefit of the top Russian and Ukrainian government officials.

That aim was demonstrated again on 10 February, when Niyazov announced on national television that Turkmenistan intends this autumn to raise the export price of its natural gas from $65 to $100 per 1,000 cubic meters. This gambit comes at a time when Turkmen gas is increasingly tied into a complex international equation, as a deal recently brokered between Ukraine and Russia depends on cheap Turkmen gas. Under the deal, Ukraine would pay an average price of $95 per 1,000 cubic meters in 2006.

Such a price hike would pinch Ukraine's economy painfully. Ukraine is slated to import 17 billion cubic meters of Russian gas and 39 billion cubic meters of Turkmen gas in 2006, according to the news website gazeta.ru. A 53 percent increase in the price of Turkmen gas would raise the average price Ukraine pays for its total imports from Russia and Turkmenistan by 20-25 percent, from $95 to $114-119 per 1,000 cubic meters. Other estimates run higher. An unidentified source in Gazprom, the state-run Russian company that handles gas exports, told the Russian business newspaper "Vedomosti" that if Turkmenistan charges $100, Ukraine would have to pay $130 for imports.

However when the Turkmen tried this before Russia called their bluff, so this time they have a different answer. Two new pipelines are in the works.

The Turkmenistan-Afghanistan-Pakistan Natural Gas Pipeline Project (the Project) is a gas pipeline of about 1,600 kilometers that will transport up to 30 billion cubic meters of natural gas annually from the Dauletabad fields in South East Turkmenistan to consumers in Afghanistan, Pakistan and possibly India. The final cost of the Project is estimated at between $2.0 to $2.5 billion. The Project will take about three years to be implemented after all key decisions are taken by the cooperating countries.

Construction is supposed to start this summer, and it will carry 20 bcm per year. And for the other, there are the Chinese

Since the mid-1990s, experts from the China Petroleum Engineering Construction Corporation have been reviving oil wells in western Turkmenistan with a total output of 2.3 million tons a year. Meanwhile, the China Petrochemical Corporation has been upgrading gas wells in the Shatlyk field with a total annual capacity of 3 billion cubic meters. . . . . . During talks between Kazakh President Nursultan Nazarbayev and his Chinese counterpart Hu Jintao in Astana in early July 2005, Nazarbayev said that constructing a Turkmenistan-China pipeline through Kazakh territory would be beneficial for all three countries.. The agreement for the pipeline is now in place

Chinese President Hu Jintao signed agreements Monday with the visiting president of Turkmenistan for the Central Asian nation to sell China natural gas to fuel its energy-hungry economy and to build a pipeline to deliver it.

Thus the gas that Ukraine is relying on to keep it out of trouble is going to start heading East instead of North, and, given past practice, that can only bode badly for the reliability of supply to such places as Italy and the United Kingdom.

In the meanwhile, Gazprom continues its heavy hand, this time in a play to control the gas flow from Iran through Armenia.

Armenia will pay $110 per 1,000 cubic meters of gas, or about half the European average, but twice what the country pays now, Gazprom, the Russian monopoly, said in a statement.

Gazprom, in turn, will buy a 24-mile section of pipe connecting Armenia to Iran -- the tiny and energy-poor country's only plausible alternative to Russian energy supplies. Also under the agreement Gazprom, through a joint venture, was granted a concession to build a second larger pipeline along this route.

There is indeed a new Great Game afoot, it's just that, at present, the cast is different this time around. Pity there isn't a Buchan, or a Kipling to keep us up to date in a more dramatic fashion.

I updated those stories in December of 2006, which was when the President of Turkmenistan, Turkmenbashi, died of a heart attack.

"One wonders if the Gazprom plan is therefore to buy and sell gas from Turkmenistan and Uzbekistan first, and run down their supply, while maintaining their own until later. The Turkmen already had large deposits, and have just discovered another very large field. It is interesting to note, however, who their projected partners are planning to be.

A huge natural gas field has been discovered in Turkmenistan, President Saparmurat Niyazov said. A field containing an estimated 7 billion cubic meters has been struck in the southeastern town of Iolotan, Niyazov said in televised remarks Sunday."A mighty fountain (of gas) caught fire," Niyazov said. "It took us three days to put it out." He said a Chinese energy company, which he did not further identify, had shown interest in developing the field with help from a company from the United Arab Emirates.Perhaps Gazprom may not have it quite as easily their own way as they expect - although perhaps that is one of the things that the Russian PM will be talking about.

Turkmenistan is the second-biggest natural gas producer in the former Soviet Union after Russia. The country's proven commercial reserves amount to 2.8 trillion cubic meters. The Russian gas giant Gazprom controls the only transit route for Turkmen gas exports to other ex-Soviet republics and Europe. Niyazov reiterated his intention to export natural gas to India, China and the United Arab Emirates through pipelines that are still under construction. "Our goal is to lay pipelines to several countries," he said. "We have also pledged to supply 200 billion cubic meters to the world market." In April, Turkmenistan concluded an agreement to build a gas pipeline to China. Beginning in 2007, it will also export 14 billion cubic meters of gas annually to Iran.As the Russian Institute of Energy Policy reports, however, China is concerned about the security of the energy supply. (And watching what is going on in Georgia who can blame them?)"

Going on to look at other posts that have been made - there are a couple more of interest, The situation is something over which Jerome and I have slightly disagreed. As I noted back then Jerome is much more qualified to comment on this than I, given his knowledge of the pipeline situation . At the time I said

"And this sort of strengthens my case that despite Gazprom's power, China has a strong interest in Turkmenistan. And in regard to the Turkmenistan pipeline, folks are still interested in investing

According to a press release issued on Friday, he said that the government was actively pursuing trans-border gas pipeline projects of Iran, Turkmenistan and Qatar as well as the import of LNG fuel.However the machinations of Gazprom, in regard to the access of Turkmen gas to the west continue. A pipeline known as the Blue Stream has been built between Russia and Turkey, and is currently carrying less gas, due to lower demand, than it was designed for. As a result it will likely be extended to Italy (where, you may remember, there were shortages earlier this year).

If the agreements are successfully implemented, Gazprom will be able to supply Russian gas directly to Italy, as well as to Spain, Greece and even Israel, while Turkey will acquire the importance of a transit center in the system of energy resources flow in Eurasia.And as Jerome pointed out the pipeline also allowed Gazprom to circumvent Ukraine in supplying gas to its Southern regions.

The Blue Stream has actually reduced to naught the plans for building the Transcaspian pipeline and organizing the export of Turkmenian gas by passing Russia. As a result, in the first place, Russia has got protected itself from a strong competitor on the European market and, in the second, it acquired the opportunity to buy large amounts of Turkmenian gas at an acceptable price. Already in effect is a contract signed by Gazexport and Turkmenneftegaz under which the deliveries of gas from Turkmenistan to Russia are to reach 70-80 billion m3 a year.

The point, I believe, wherein he and I differ, relates to the influence of the Chinese. Since, as I noted earlier, they are already in Turkmenistan, and do have a need for the gas, they are motivated toward the pipeline. And as you may have noticed from this post and the last, it would appear that the Turkmen have yet to get a decent deal from Gazprom, which would motivate them also to find a better, and more lucrative customer. So I think, in this case, I will stick with my original prediction that the pipeline to China will go forward."

Tom Nichols, writing on the Robert Amsterdam website was commenting about the pipelines in the are the other day, noting that

For now, there is only one realistic source of gas for Nabucco: the South Caucuses Pipeline (SCP). Due to start up around the end of the year, the 690 km pipeline will export gas from Azerbaijan, through Georgia to the Turkish border - along the same corridor as the Baku-Tbilisi-Ceyhan oil pipeline. It will be supplied largely from Azerbaijan's Shah Deniz field, in the Caspian Sea. Flows are expected to be in the region of 7bn cm/y initially, rising to around 16bn cm/y after 2012, says BP, the operator of Shah Deniz. . . . . . . The infrastructure, commercial agreements and political support for flows from other sources, however, remain to be established. Theoretically, says Ruttenstorfer, they include all the countries around Turkey that have sufficient gas to export - Russia, through the under-utilised Blue Stream pipeline, Turkmenistan, Kazakhstan, Iran, Syria and Iraq. But there is no direct infrastructure to tie gas from Turkmenistan and Kazakhstan into Nabucco and there are doubts about how much spare gas Turkmenistan has. There is also no infrastructure to bring gas from Iran, Syria or Iraq to Nabucco and political circumstances are unfavourable in all three cases.

UPDATE

Thanks to Jack Greene for direction to a couple of Radio Free Europe features. The first expands on Gazprom's supply problems, and it's anticipated answer.

Domestic shipments at regulated, reduced prices totaled 258 bcm in 2004 and 325 bcm in 2005, when they generated losses of nearly $1 billion, Prime-TASS reported on 29 November. Exports to the West, which account for the bulk of Gazprom's profits, are planned at 151 bcm in 2006 and set to rise to 163 bcm by 2008, Prime-TASS reported on 23 November. . . . . . . Gazprom plans to buy 9 bcm from Uzbekistan and 30 bcm from Turkmenistan in 2006, ferghana.ru reported on 23 January. Purchases from Turkmenistan are slated to go to 70-80 bcm a year by 2007-08, Prime-TASS reported on 30 November. With these boosts looming on the horizon, Gazprom hopes to expand the capacity of the Central Asia-Center pipeline, which links Turkmenistan and Russia through Uzbekistan and Kazakhstan, from current levels of 42 bcm/year to 55 bcm/year, and is considering another project linking Central Asia and Russia with throughput capacity of 30 bcm/year, Prime-TASS reported.while the second suggests that Gazprom has reached a peak production at 550 bcm.

And with this as background we'll see if we can update the story fairly soon.!

It is the best time to make a few plans for the future and it is time to be happy. I have learn this post and if I may just I desire to counsel you some interesting things or advice. Maybe you can write next articles referring to this article. I desire to read more things about it!BTU Meters.

ReplyDeletecông cụ dụng cụ

ReplyDeletethủ tục thanh lý tài sản cố định

bảng cân đối kế toán

thuế thu nhập cá nhân năm 2015

phần mềm htkk 3.3.1